Photo illustration courtesy of stevepb, pixabay.com

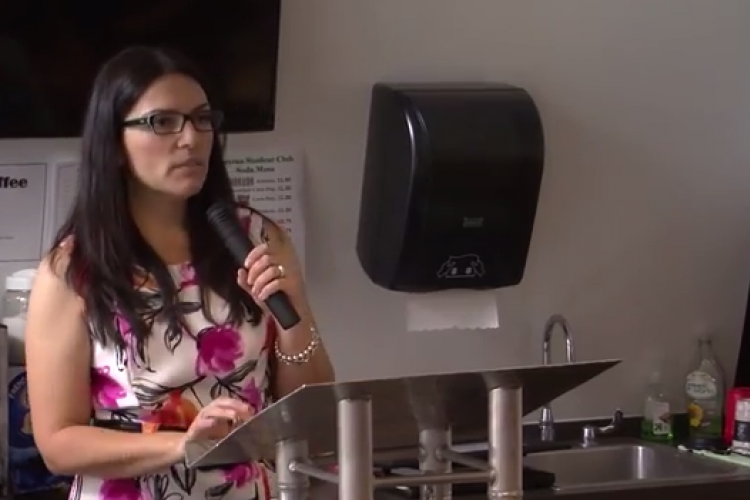

Investing for retirement is not on the agenda of most 20-year-olds. Nevertheless, John Durazo, 20, started his investment portfolio in 2019 while he was working at Yuma Investment Group Wealth Management.

“Working in a financial firm has shown me the importance of wealth planning and how planning for your retirement affects not only yourself, but those after you,” he said.

Top financial experts recommend starting to put away money for retirement as soon as possible, even if it’s in minimal contributions. The earlier a person starts saving, the less they have to contribute to reach their goal. Someone who makes small but continuous investments made at a young age benefits the most because they can contribute a lot less and make more than someone starting when they are older.

For example, let’s say your goal is to have $1 million at the age of 65. According to the popular investment management company Vanguard, if putting away just under $4,500 each year starting at age 20, offers a good chance of meeting that goal. That means contributing under $400 per month compared to $750 per month starting at age 30 and $1,500 per month at age 40 to reach the same $1 million goal.

Compounded interest, which is simply interest earned on interest, also plays an important role in saving for retirement when young. Interest accumulates over time, so by reinvesting your earnings, you are exponentially increasing your total return on investment. Even if you have to stop contributing for some reason, you will still earn more than someone who started 10 years after you just because of compounded interest.

Durazo started with an advisor at Yuma Investment Group, but once he attained more knowledge on how to invest independently, he became his own money manager through TD Ameritrade.

“I do pretty moderate to aggressive investments since I’m so young and have a lot of years to pretty much play with my money,” he said.

What advice does he have for young people who want to start investing?

“Do your research, watch a lot of videos and try to attend local seminars that explain the importance of retirement,” he says. “You can also find a great advisor to manage your money well, and they’ll listen to your exact investment objective to help you grow from there.”

Retiring with a million dollars and the beach house you’ve always dreamed of may not seem so unattainable if you know the secret to investing – time. Getting a head start on your retirement is extremely beneficial in the long run. By investing as soon as possible, you will do your future self a favor by significantly reducing the amount you need to put away each month and letting the compound interest grow your money. There are many trusted web sites where you can learn more about investing, such as Investor.Vanguard.com, TDAmeritrade.com and NerdWallet.com.